Through our 2030 Fund, MassCEC invests at the earliest stages of company development across the climatetech landscape. With a focus on tough tech and underserved sectors, MassCEC investments aim to advance clean technology, fill funding gaps, create green jobs, and leverage private capital throughout the Commonwealth.

2030 Fund

MassCEC makes direct equity and venture debt investments in Massachusetts-based clean energy companies.

Investment Goals

cb9e.png?itok=og70_G2z)

Reduce Greenhouse Gas Emissions

Support start-ups and technologies that have the greatest potential to reduce GHG emissions

Advance Clean Energy Technology

Support progression of cleantech in clean energy generation, net zero grid, transportation, buildings, and other decarbonization technologies

Reduce Ratepayer Energy Costs

Support technologies that economically produce clean energy -- reducing costs and volatility

Create Jobs in Massachusetts

Invest in companies that will support and create economic activity and quality green jobs in the Commonwealth as they expand

Attract External Capital to Cleantech

Leverage outside capital to support clean technologies, projects, and companies through all stages of growth, from both private and public sources

Fill Funding Gaps

Serve as a funding source, especially in areas that are not currently well served by the market

Generate Financial Returns

Balance both financial and programmatic risk and reward, re-investing returns to further support the clean energy industry

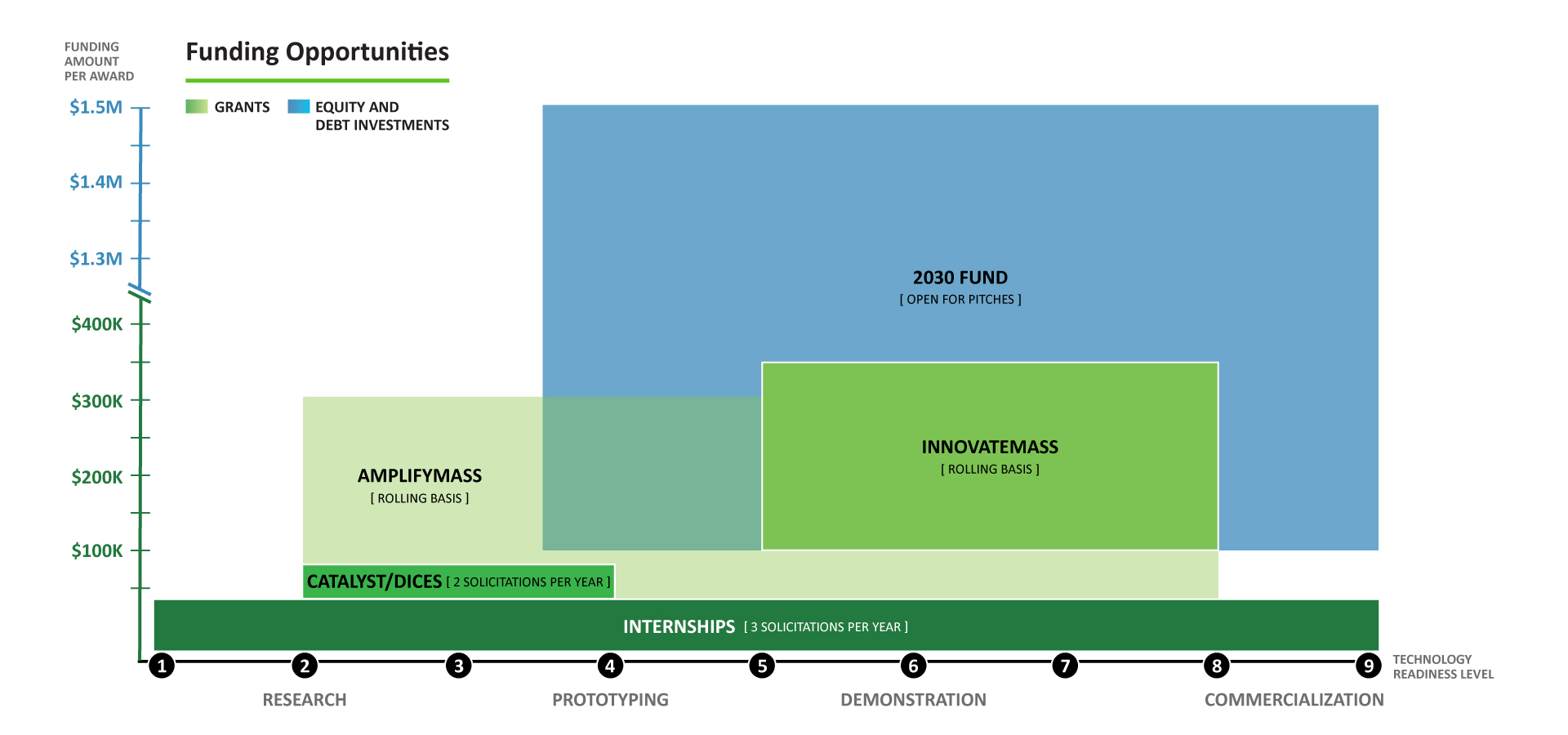

A Continuum of Support

Alongside the 2030 Fund, MassCEC's Technology to Market programs offer non-dilutive grants and support for Massachusetts-based researchers and companies along the entire technology readiness spectrum.

MassCEC's Investments Make an Impact

$17M+

Invested in 38 Companies

$1.3B+

Leveraged External Capital

21

Successful Exits

Additional Funding Opportunities

Catalyst and DICES

$75,000

March 14, 2024

AmplifyMass

$300,000

Rolling

InnovateMass

$350,000

Rolling